In short, those who do not have a year end between 31 March and 5 April, will need to reapportion profits correctly during the current 2023-24 transition year and moving forward, whilst considering whether changing their accounting year is beneficial for them.

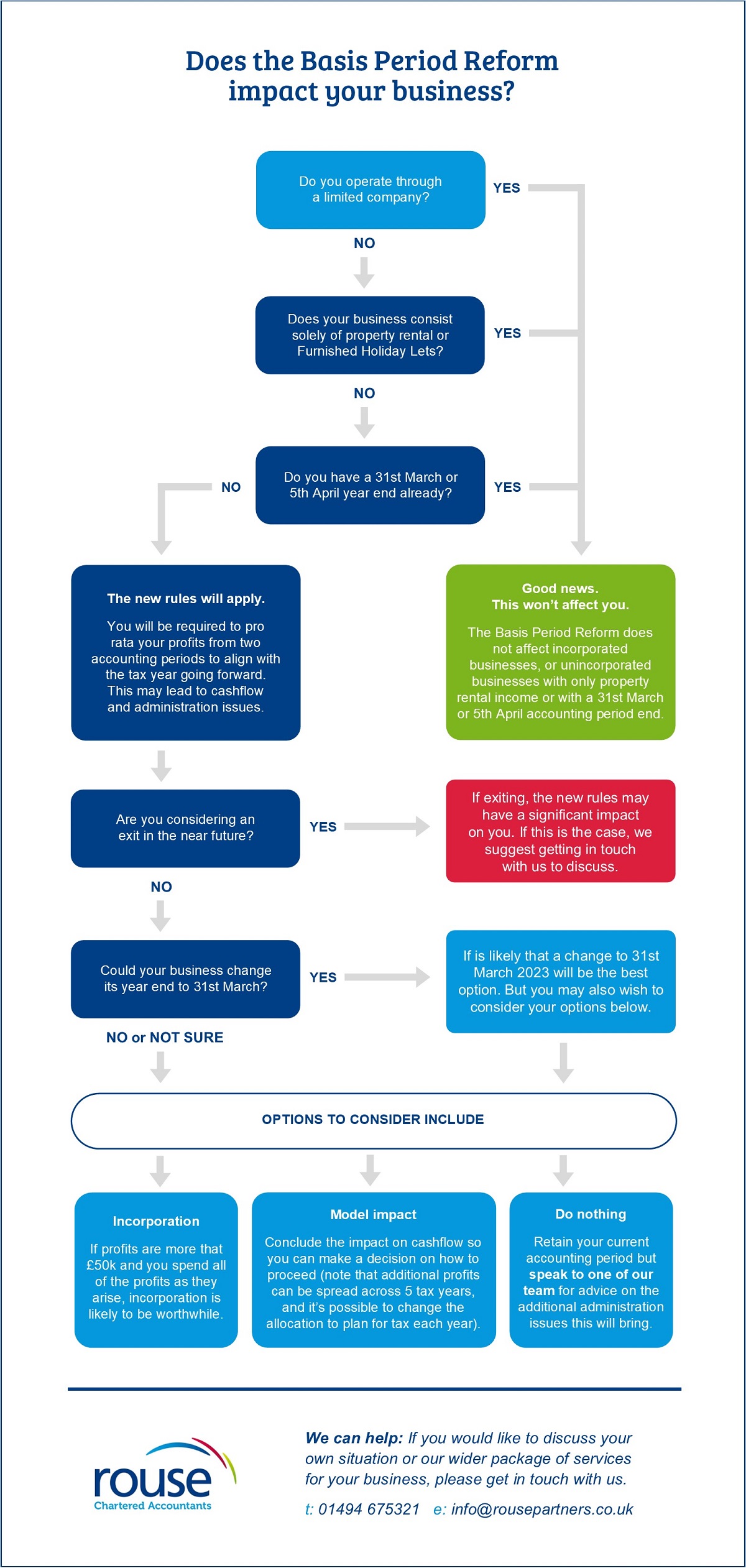

In this article we discuss the Basis Period Reform and have included our flowchart to help you determine if your business is impacted, as well as covering various FAQs.

What is the Basis Period Reform and why is it being introduced?

The Basis Period Reform will involve moving from a ‘current year’ basis to a ‘tax year’ basis. This will mean that business profits are calculated to the tax year, rather than to the accounting period if this is different from the tax year.

This simplifies the basis period rules for the self-employed and partners so that a business’s profit or loss for a tax year is the profit or loss arising in the tax year itself, regardless of its accounting date. This removes the complex basis period rules and eliminates further overlap relief in future years.

Who will it affect?

The basis period reform will affect businesses including:

- sole traders

- partners in trading partnerships including LLPs

- other unincorporated entities with trading income such as trading trusts and estates

- non-resident companies with trading income charged to Income Tax.

However, it will only affect businesses with an accounting date which does not already align with the tax year (i.e. not with a year end between 31 March and 5 April). There are an estimated 528,000 sole traders and partners with non-tax year basis periods.

Managing your transitional year (2023/24)

The current 2023/24 tax year is a transitional year in which business must move from the old basis to the new basis and they will be assessed on the following profits:

- The profits of the accounting period ending in the tax year

- The profits from the period starting immediately after the end of that accounting period to 5 April 2024, less any available overlap relief brought forward

Using an example of a 30 September year end, this would result in the profits of the year ending 30 September 2023, as well as the following period 1 October 2023 to 5 April 2024 (i.e. 18 months’ profit), all being taxable in 2023/24 (albeit reduced by any available overlap).

If this profit exceeds the profit for the first 12 months of the extended basis period, spreading provisions apply. These are called ‘transition profits’ which can be spread equally over five tax years, including 2023/24. The business can elect to be taxed on them sooner and any untaxed transition profits are taxed automatically on cessation of the trade.

The ‘new rules (2024/25 onwards)

From the 2024/25 tax year, all unincorporated businesses will be subject to tax on the profits arising in the tax year, regardless of what date their accounts are drawn up to.

For those businesses who do not adopt a 31 March or 5 April year end they will have to apportion their profits on a pro-rata basis to determine the taxable profit for the tax year. Whilst this will creates some accounting changes, it will remove the concept of overlap relief and all the disadvantages and complexities that come with it.

There may be particular challenges for those who prepare accounts to a date later in the tax year. For example, businesses with a 31 December year end currently have 13 months to finalise their figures. Moving forward, they will have just one month – so in 2024/25, where the filing deadline is 31 January 2026, they will be assessed 9 months from the year ended 31 December 2024 and 3 months from the year ended 31 December 2025.

What should I be doing now?

If you are impacted by the Basis Period Reform, you should now consider:

- Cashflow – Will these changes impact your cashflow and do you require additional funding, particularly in relation to the tax due in January 2025 (which is when any potentially significant ‘catch up’ payment is likely to be).

- Change of accounting date – Consider the advantages of adopting an accounting date of 31 March or 5 April going forward to align with the tax year and, the appropriate timing of such a change. There are commercial factors to consider, particularly for international businesses and those in corporate groups where a change from a 31 December year-end may not be feasible.

- The timing of accounting and tax computation work – Can you plan for a shorter tax return preparation timetable? i.e Does this need to be brought forward to avoid estimates which then have to be amended at a later date (thus adding to the cost)?

- Communication – Some partnerships will prepare tax return for their partners, whilst others leave partners to arrange their own tax affairs, in which case the partnership must decide if it will prepare the apportionments and estimates for partners. You might consider providing FAQs, information and/or partner seminars to help them understand the impact of accelerated tax payments and potential additional funding liabilities.

We can help

Many businesses will already be part way through their transitional accounting period, so now is the time to review the impact on your business and make any necessary decisions.

We have been speaking to and advising clients who are impacted by the Basis Period Reform so that they are prepared in advance for these changes. If you would like to discuss your own situation or our wider package of services for your business, please contact us.

Award-winning chartered accountants offering tax, audit and advisory services.